Predicting market waves in SaaS

How to catch the market at the right time

I’m writing to you all from Williamsburg today. I just got back from 10 days in LA and I already forgot what it was like to walk so much. Walking seems to activate my writing brain, because after 15,000 steps this evening, I was finally able to put this piece together. You’ll be hearing from me more, as I simultaneously rack up those miles on Strava.

Product market fit is the holy grail of startupland. There are a number of iconic blogs on the topic, like this 2017 interview with the Superhuman founder. They tend to focus on the process of navigating to PMF — finding the right metrics, segmenting users, iterating on feedback. But all of these tactics are pretty much moot if you don’t get one key thing right: Timing.

Timing the market is the highest leverage decision you’ll ever make for your company. No matter how well you build towards PMF, you’re limited to the available surface area within the market you choose. You can find PMF in a $0.1B market and you can also find PMF in a $6B market. There are still great businesses to be built in the former scenario ($100M is a lot of money), but if you’re going down the venture path, you can’t aim for anything short of a few billion.

Finding PMF is like surfing — you can have the right board, the right form, etc but surfing a great wave requires picking the right wave and timing it just right, to catch the force behind you. And of course, just like when you know you’ve caught the wave, you’ll know when you’ve got PMF.

As a founder, you only get a few chances to surf. There are plenty of markets you can choose from, and in any given moment it can be hard to tell how certain markets are shaping up. It only becomes apparent on longer time horizons, of 5-10 years:

Luckily, there are a few ways to observe the water and catch market waves at just the right time.

New technologies

New tech enables new types of SaaS products. But, more importantly, new technology creates hype and attention. For example, AI is very much top of mind these days, and because companies want to look like they’re “with it,” they’re more likely to make fast purchasing decisions in that area. Shortened sales cycles are the greatest side effect of this wave.

But to ride the wave, you can’t just build an app with new technology and expect buyers to jump on it; you’ll need to get really good at FOMO engineering and learn to sell at the executive-level sell. The biggest opportunities lie in convincing Fortune 500 CIO’s (who temporarily feel like fish out of water around the new tech) that your SaaS will bring them into the future.

Build vs buy mindset shifts

New layers of the tech stack emerge as a result of new tech. Since an organization can only maintain so much headspace for building infrastructure in-house, new technology will often edge out an old ‘layer’ of the stack. Companies will adopt more of a buying mentality for that particular area of work.

A good example of this is cloud computing. Prior to AWS, a lot of companies were adamant about maintaining their own server infrastructure. Then there was an inflection point — there was more pressure to move fast, fewer customers cared whether their vendors self-hosted, and there were also more web technologies to keep up with. SaaS companies can’t possibly build everything themselves, so eventually the whole market tipped towards buying (vs building), and gave in to 3rd party cloud computing infrastructure.

New classes of workers

In 2005, the National Science Board advocated for a data science career path to ensure that there would be experts who could successfully manage a digital data collection. In 2013, Harvard Business called data science “the sexiest job in the 21st century.”

When new types of jobs emerge, the power balance inside organizations changes as well. Once there’s a critical mass within a company, this new class of workers gets a pretty hefty budget of their own. This can potentially means a huge new market for persona-specific SaaS products.

Alternatively, even if a new market isn’t created, a new type of worker means a new potential champion for existing SaaS vendors. Sometimes, categories evolve to cater more towards a persona. You can see this with CDP software — ultimately marketers use CDP’s, but because data scientists had to implement them, they ended up becoming the buyers and the people vendors had to court.

Distribution channels

When you think “App Store,” you might think Apple. But Salesforce’s CEO Marc Benioff was the original owner of the “App Store” trademark. Salesforce AppExchange was launched in 2006, after which Apple launched the App Store in 2008. Even in just its first 5 years, it rocketshipped in growth.

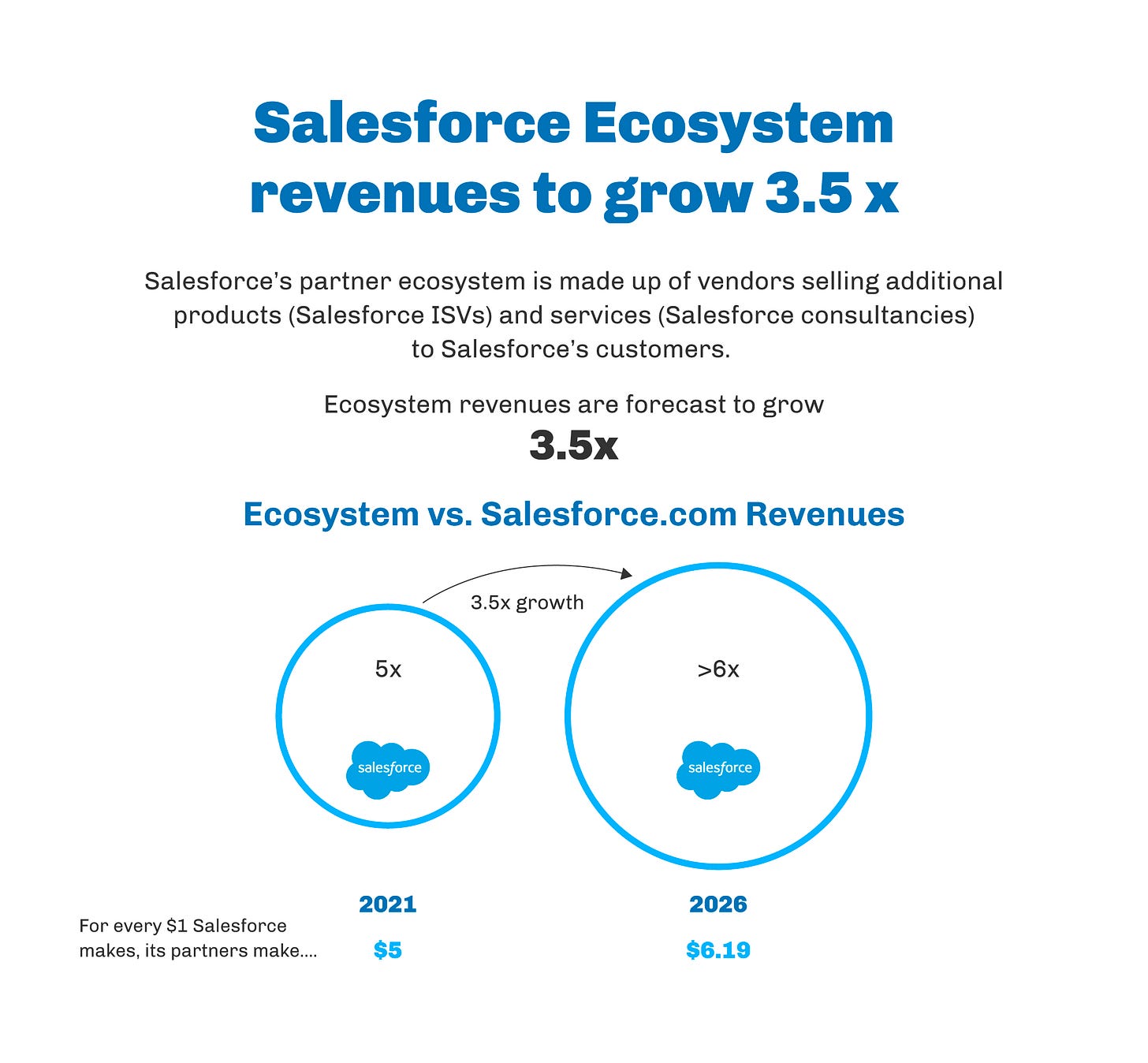

And there’s a reason for that — for every $1 Salesforce made in 2021, $5 went to its ecosystem vendors. IDC estimates Salesforce generated $20 billion in 2020 revenue for its 2,000+ ISV partners.

If you caught onto this early, you would have had a great time surfing the Salesforce wave, or Shopify, ServiceNow, Atlassian, etc later on. There are only a handful of these types of opportunities every decade. The ecosystems worth exploring are usually from companies that are just about to or have freshly IPOed (Salesforce listed in 2004, two years before their AppExchange launch), so I would keep an eye on Stripe, Figma, Webflow, and a few others.

Making the most of where you’re at

If you’re in the early stages of building, now’s a great time to check your hypotheses on the market you’re after. If you’ve already started building, think deeply about if the push you’ve felt is enough. Either way, best of luck, there are some great waves out there for you to catch.

As always Sara, you have one of the highest impact/word ratio of anything I read. Thanks for writing!

Really enjoyed reading this article on predicting market trends in the SAAS industry. The strategies discussed here make a lot of sense and provide some great insights for navigating the ever-changing landscape. Definitely going to keep these tips in mind. Thanks for sharing!